30-second summary:

- Pureplay retailers will dominate in the future

-

- Amazon, Alibaba, Pinduoduo forecasted to be the leading retailers in 2024

- Pureplay operators better equipped to build on profitability

- Amazon’s model helps them invest heavily on quick tests and learning exercises

- But don’t rule out store-based retailers (aided by partnerships) just yet

-

- Omnichannel retailers are leading the UK market currently

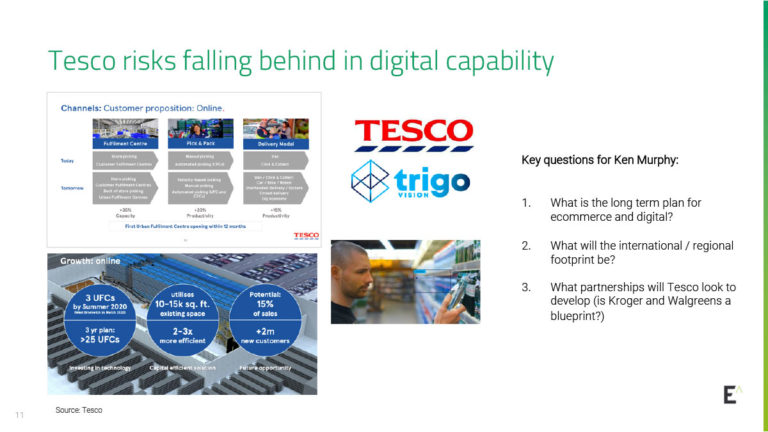

- Tesco have held their own until now, but what is their plan to combat the digital invasion?

- Partnerships the way forward for store-based retailers

- Amazon’s weaknesses will give birth to the next success stories in retail

Last week we hosted our first Marketing Technology Happy Hour in London (it is usually held in New York), with Jumpshot’s Stephen Kraus and Edge by Ascential’s Nick Everitt giving insights on the state of ecommerce today, and the key trends that will shape the digital world of tomorrow. Here are the key takeaways from the event:

Pureplay retailers will dominate in the future

Ecommerce is growing nearly three times faster than store-based companies. As a result pureplay retailers like Alibaba, Amazon and JD.com are projected to dominate the retail sector by 2024.

While Alibaba is expected to be the top retailer globally, Amazon blows every company out of the park when it comes to generating strong profitability. Through Amazon Web Services (AWS) alone the ecommerce giant had 60% profits in 2018 from just 11% of sales.

This model enables Amazon to experiment and invest heavily in areas where they have low volume but enjoy a high rate of conversion, such as: CPG; household essentials; personal care; etc.

“There is no doubt the pureplay ecommerce leaders, such as Alibaba, Amazon and JD.com are transforming ecommerce globally. Their vast digital ecosystems enable them to lock in consumers across multiple touchpoints, from retail to entertainment to cloud computing. This provides them with vast amounts of customer data, and combined with their ability to invest for the very long-term means that it is incredibly difficult for traditional store-based retailers to compete,” says Nick Everitt, Director of Advisory, Edge by Ascential.

Don’t rule out store-based retailers just yet

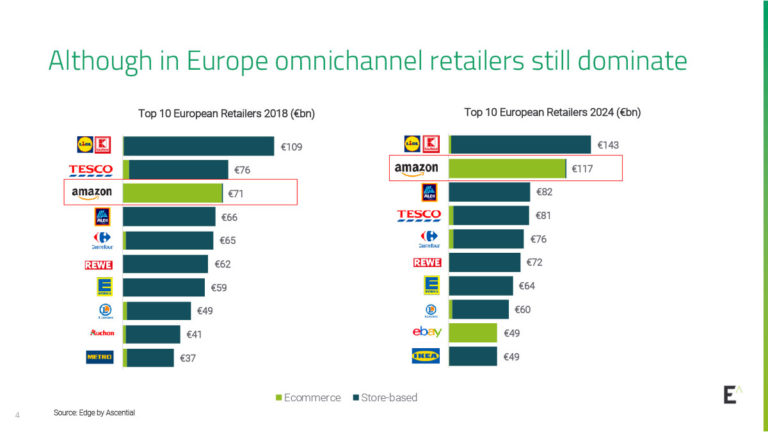

It isn’t all doom and gloom for store-based or omnichannel retailers though. In Europe, in particular, Amazon is the only ‘purely ecommerce’ company in the top 10. And this isn’t foretasted to change much in five-years as only eBay is expected to crack into the top 10 by 2024.

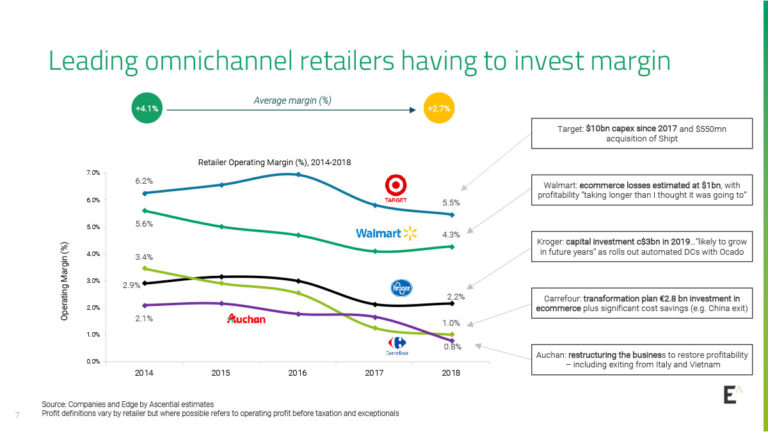

However, a big hurdle for store-based and omnichannel retailers is the high cost of investment they need to make in digital to just compete with the likes of Alibaba and Amazon. All the major store-based American retailers have seen their operating margins dip since 2014, with Walmart’s estimated losses from ecommerce said to be a billion dollars.

Nick comments: “Investment in ecommerce and digital is putting significant pressure on retailer margins globally. However, leading players such as Walmart and Carrefour are seeking to manage profitability while transforming their businesses at speed. This includes leveraging stores for online grocery pick up (or ‘click and collect’) as well as building partnerships with third parties in areas such as artificial intelligence and online delivery. In fact, any retailer not investing in partnerships simply risks being left behind, as it is essential to test, learn and move at a much quicker pace than ever before.”

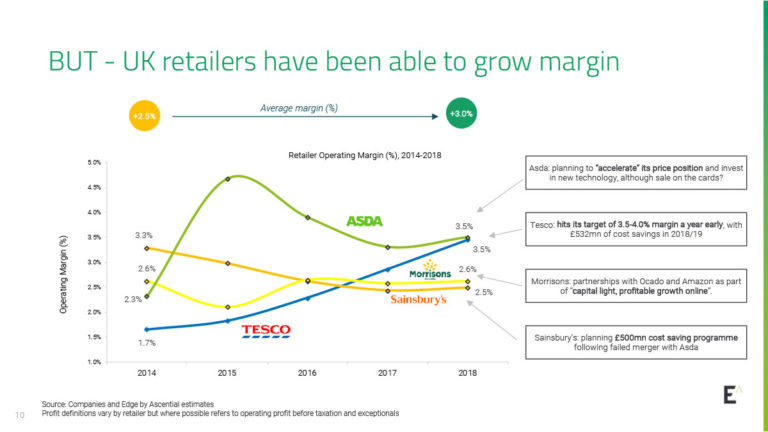

These partnerships, particularly in the field of distribution have been a shinning light for store-based retailers. In the UK retailers like Asda and Morrisons’ investment in digital and partnerships have seen their margins grow.

The best performer in the UK though has been Tesco by a country mile. Following the announcement that Ken Murphy will be taking over as CEO from Dave Lewis, Tesco claim to have established a more profitable, increasingly cash generative online operating model, which will enable them to forge ahead with plans to double its online capacity.

Tesco will open three urban fulfillment centers by summer 2020 and plans to open more than 25 over the next three years. It also reported a 77 per cent increase in Clubcard app users to 1.54 million.

Amazon’s weaknesses will give birth to the next success stories in retail

So what then does the future hold? Who will be leading retailers of tomorrow? The obvious answer to that is of course the like of Amazon and Alibaba. However, as unstoppable as Amazon are, they too have their short comings and this will possible lead to the next big thing in the retail space.

“Amazon is a phenomenal business which is relentlessly focused on the customer. However, Jeff Bezos has a healthy degree of realism, and was quoted last year as telling employees “Amazon is not too big to fail”. What is clear is that the pace of digital innovation will continue to give birth to new solutions and retail models. It is likely that the future winners of tomorrow probably don’t even exist today,” says Nick Everitt.

The signs of this are already there, Chinese retailer Pinduoduo, who see themselves as the anti-Amazon, are expected to be among the top five retailer by 2024, despite only coming into existence in 2015. Amazon’s apparent weakness in sectors like food/groceries and furniture has seen the likes of Chewy and Wayfair capitalize.

As Nick proclaimed during the Happy Hour, there will always be advancements in technology and solutions, the retailer that keeps pace with that is likely to the leader of tomorrow.

source https://www.clickz.com/the-state-of-ecommerce/258143/

No comments:

Post a Comment