30-second summary:

- Transactional advertising focuses on reaching consumers at the point of sale, motivating an immediate action or interaction with a business.

- Transactional advertising has gone digital, presenting a huge opportunity for retailers to reach customers while they’re banking, actively shopping, or browsing for goods online or offline.

- Shoppers are becoming more reliant on fintech tools to conduct transactions, connect with businesses, and find the best deals.

- In this post, we’ll review three digital marketing opportunities for merchants which are tied to fintech solutions: card-linked offers, banking as an ad platform, and digital deal finding.

Transactional advertising focuses on reaching consumers at the point of sale, motivating an immediate action or interaction with a business—not just online, but in stores with POS systems like Square and Stripe. Powered by fintech tools like Dosh and Cardlytics, transactional advertising has gone digital. This presents a huge opportunity for retailers to reach customers while they’re banking, actively shopping, or just browsing for goods online or offline.

Fintech as an advertising channel is effective for several reasons. First, the use of credit and debit cards has increasingly replaced cash as consumers’ preferred method of payment. A 2019 study by the US Federal Reserve found that consumers use cash for just 26% of purchases, although this number is higher (47%) for “small value” purchases under $10.

Shopping behavior is also changing—and this change goes beyond people pivoting from shopping in stores to shopping online (that’s happening too with McKinsey reporting a 15-30% growth in consumers who purchase online.)

Shoppers are becoming more reliant on fintech to conduct transactions, connect with businesses, and find the best deals. Since the pandemic began, consumers have been switching brands at an unprecedented rate, a behavior fueled by economic pressure, changing priorities, and store closings.

All this change has created three unique digital marketing opportunities for retailers which are tied to fintech solutions.

Opportunity #1: Card-linked offers (CLOs)

Cash back programs are nothing new to the retail and finance sectors. The first cash back reward program was rolled out by Discover Financial Services, a division of Morgan Stanley, in 1986. The concept was simple. Morgan Stanley gave Discover cardholders a small percentage of cash at the end of the year based on how much they charged on their credit card. Voila, the credit card rewards program was born.

Now, more than thirty years later, rewards programs are ubiquitous and offer consumers a way to earn a little money based on where they shop. Fintech solutions like Dosh, a cash back app that partners with merchants and financial institutions, connect retailers directly to the wallets of consumers by automating the cash back and rewards process through card-linked offers (CLOs.)

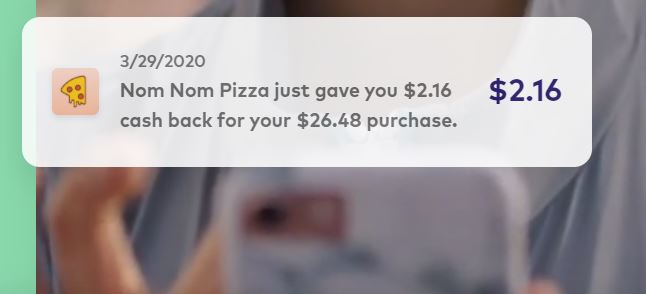

The Dosh app enables consumers to link their preferred card or payment method to the app. Users can see which retailers and brands have available offers and once they link their card and make a purchase at a participating merchant, the cash back reward is deposited into their Dosh “wallet” and ultimately transferred to a bank account, PayPal, or Venmo, or to a charity of their choice.

This is a fairly “frictionless” process, but it still requires downloading an app and connecting your credit cards. To make the process even more seamless, Dosh recently rolled out a solution that powers rewards programs for financial services companies so they can provide “automatic, instant, card-linked cash back experiences to customers.”

The program removes the need for consumers to download the Dosh app, since the cash back functionality is enabled within the financial institution’s user interface.

We reached out to Dosh for a comment about the new solution.

Amy Vale, Dosh’s CMO, wrote, “Since August, Dosh has integrated our cash back experience into payment providers such as Venmo, Jelli, Betterment, among several others, and our audience continues to grow exponentially with each new partnership. Marketers are well versed in developing their traditional and digital strategies, and we’re excited to help brands carve out their ‘wallet strategy’. In order to win in today’s environment, marketers must be nimble, yet strategic in how they communicate with, and add value for their customers where it matters most: their wallets.”

Retailers and local businesses who want to reach the (millions of) consumers who access Dosh through various financial institutions, can do so by advertising cash back promotions and other offers on the platform.

Dosh promotes cash back offers through their app and email communications. Through Dosh, either in the app or via one of its partner financial institutions, shoppers can search for cash back offers on their mobile devices and find deals by brand or location.

Example of a Dosh mobile alert—Source: Dosh

Example of a Dosh mobile alert—Source: Dosh

A study by Forrester found that retailers who use Dosh saw an average of 48% increase in order value and had an incremental ROAS gain of 7.9.

Opportunity #2: Banking as an ad platform

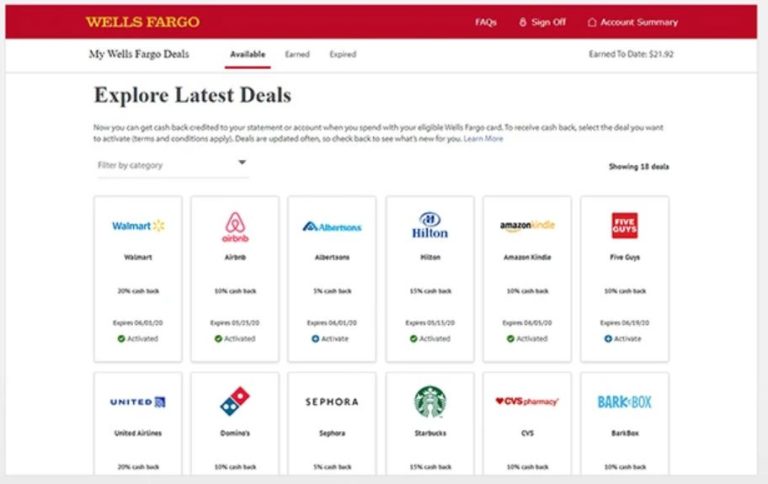

Cardlytics is a fintech platform that works directly with banks to provide cash back offers to their users. The platform boasts 1.6 million active monthly users (or 50% of all card swipes in the US and UK). For retailers and merchants, Cardlytics provides a unique way to reach customers by integrating ads within banks’ online, mobile, and email channels.

Cardlytics’ list of financial partners is impressive and includes Chase, Bank of America, Wells Fargo, and many more. Cash back offers appear within the banking interface, so consumers can plan where they want to shop.

A list of cash-back offers that appear within a Wells Fargo credit card account—Source: Cardlytics

A list of cash-back offers that appear within a Wells Fargo credit card account—Source: Cardlytics

Cardlytics uses data from online and in-store purchases to target campaigns within the platform and measure results. This intelligence helps answer critical questions like where a retailer is losing or gaining market share, what competitors customers are shopping with, and how often customers shop for a specific category of goods in the retailer’s store versus overall.

Cardlytics is unique in the ad tech space in that it reaches only verified users—people who have bank accounts and are actively managing their money. Many top brands are already using the platform including Lowe’s, PetSmart, and Kroger.

Opportunity #3: Digital deal finding

While Dosh and Cardlytics are focused on cash back opportunities, sometimes you just want to save a little money at the point of purchase. That’s where deal finding apps and plugins truly shine. Deal finding tools like Honey and RetailMeNot provide multiple ways for shoppers to save money by automating the coupon clipping process. Most deal finding platforms have a cash back component as well.

RetailMeNot is an excellent an example of digital deal finding, with multiple tools that enable retailers to connect with shoppers across the entire customer journey, both online and offline.

RetailMeNot’s mobile app alerts shoppers to sales taking place in physical stores based on the user’s proximity to the store. The browser plugin pops up when a user is in a retailer’s shopping cart, enabling them to test coupons or get cash back. Retailers can also place ads on RetailMeNot’s website and in their email campaigns.

Over 31 billion digital coupons were redeemed worldwide in 2019 and over 90% of consumers have used some sort of coupon. Deal finding platforms that automate the process of clipping and using coupons are a great way to reach shoppers, drive sales, and foster brand loyalty.

As part of the trifecta of fintech advertising solutions, they offer merchants another targeted way to motivate shoppers and generate growth.

source https://www.clickz.com/three-ways-merchants-can-leverage-fintech-to-reach-shoppers/264194/

No comments:

Post a Comment