30-second summary:

- Shining holiday lights on US consumer intentions for holiday shopping with age group profiles and more.

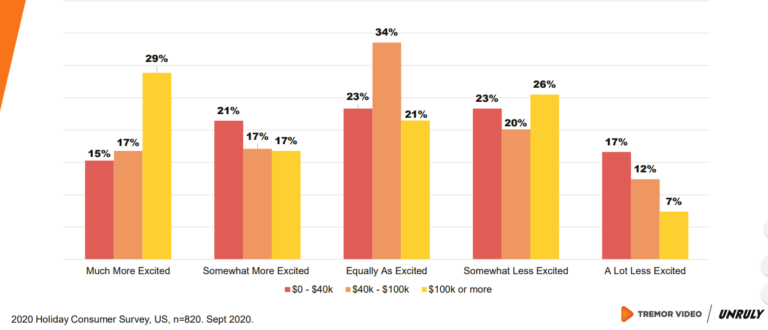

- The overall holiday shopping sentiment remains positive across all households with incomes from $40K to $100K.

- Most excitement can be seen in households that fall between the income range of $40K to $100K.

- Where businesses can capture consumer attention during the holiday season 2020.

- Key elements to consider for your holiday ads and messaging.

- Top holiday gift choices and the sharp shifts in cross-border shopping for gadgets.

- “Winter is coming” and so is the rise in TV, internet, and online shopping trends. Dive in to discover these insights.

Acing holiday shopping sales is no piece of cake. This week we help you dissect all the elements across holiday shopping, consumer intentions, marketing, advertising, sales, with a frosting of the feelings you can tap into for bigger slices of revenue.

Holiday shopping to peak in November

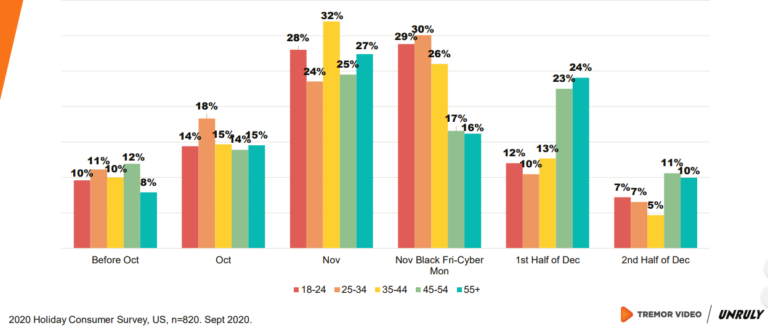

Unruly and Tremor Video’s recently launched study shines some holiday lights on US consumer intentions for holiday shopping. Here’s an age group profile of the holiday shopping peaks:

- November: 35-44 and 55+

- Black Friday, Cyber Monday (November): 25-34 and 18-24

- December 1st to 15th: 55+ and 45-54

- December 16th to 31st: 55+ and 45-54

Where will your consumers shop

- Only online: 18-24 and 25-34

- Mostly online but in person with someone: 35-44, 25-34, 18-24, and 45-54

- Online as well as in person: 55+

- In person only: 55+

Key elements for holiday advertising

Here’s a prioritized list of how people/consumers want holiday ads to make them feel:

- Warm (40%)

- Happy (57%)

- Inspired (36%)

- Nostalgic (30%)

- Amused (21%)

In terms of advertising and messaging, nearly 50% of consumers under 55 years feel businesses should reference COVID-19 in their ads. A closer look at the age profiles that strongly agree with the above looks like this:

- 18-24 year olds (31.2%)

- 25-34 year olds (22.9%)

- 35-44 year olds (24.7%)

- 45-54 year olds (21.9%)

- 55+ year olds (8.7%)

In addition to this, the majority of people (56%) thankfully aren’t being adventurous and plan on staying indoors during the holidays while a mere 4% intend to travel overseas followed by 25% planning to travel within their respective state.

Of these adventurous wanderers that plan on traveling, 56% plan on traveling by road in their own cars.

Winter brings warmer sales and leads: Consumers’ preferences

“Winter is coming” and so is the rise in TV, internet, and online shopping trends.

The overall holiday shopping sentiment remains positive across all households with incomes from $40K to $100K. In fact, most excitement can be seen in households that fall between the income range of $40K to $100K.

As consumers will stay indoors more these are their most favorite activities they will engage in:

- Watching TV: 28% of people will watch TV much more than usual

- Browse the internet: 30% of people will spend much more time surfing the internet

- Paying video games: 18% of people will game much more than usual

In addition to these, holiday plans include:

- 27% will shop online much more than usual

- 19% will resort to virtual meetups with friends and family

- 10% will dine out much more than usual

- 16% will order takeout much more than usual

Top holiday gift choices

- Clothing (49.4%)

- Beauty & Personal Care (27.2%)

- Toys (33.4%)

- Electronics (28.7%)

- Food (27.7%)

- Alcohol (15.4%)

Gadgets consumers are keen on buying this holiday season

In light of the Global Shopping Festival (Nov 11, 2020), leading global retail online marketplace, AliExpress closely observed sharp shifts in cross-border shopping as consumers search for better-priced technology products. These were the key findings in macro-developments and shifts in online shopping behaviors that have been affected by COVID-19:

- Sharp peaks in tablets, electric scooters, mobile phones, smartwatches, and TVs

- Tablets: 50% increase in GMV

- Electric scooters: 225% increase in GMV

- Mobile phones: 60% increase in GMV

- Smartwatches: 140% increase in GMV

- TVs: 67% in GMV

TVs are a stand-out product category as AliExpress saw a month-on-month increase in TV bookings from April to August 2020.

Marketing Innovation Forum: Marketing Automation

As we covered our latest virtual half-day peer-peer event live on Twitter, our amazing panel of marketing automation experts and futurists enlightened thousands of marketers and senior executives from across the globe with their wisdom and wit. Here’s a small glimpse for you. Stay tuned to find out how you can get your hands on the highlights and marketing technology intel.

Most exciting things on #future of #marketing:

1. Unified platform for people and accounts for a single #customer view #B2B @Demandbase

2. Moving from automation process @DeloitteDigital

3. Validations and process @Purple

4. Unify #organization to match expectation @briansolis— ClickZ (@ClickZ) October 22, 2020

ClickZ readers’ choice for the week

This week our readers have been most inclined towards the future scope of B2B marketing, Amazon Prime Day highlights, industry key insights, and growth marketing.

- Future of B2B marketing: Are you heading in the right direction?

- Key Insights: Amazon Prime Day 2020 highlights on sales and funding

- The key to growth marketing during uncertain times

source https://www.clickz.com/key-insights-holiday-shopping-november-spotlight-age-profiles-preferences-and-more/263954/

No comments:

Post a Comment